Catherine Griffin

Philadelphia, Pennsylvania, USA. Impact translator and data lover. Democratizer of impact data. Founder and adjunct professor.

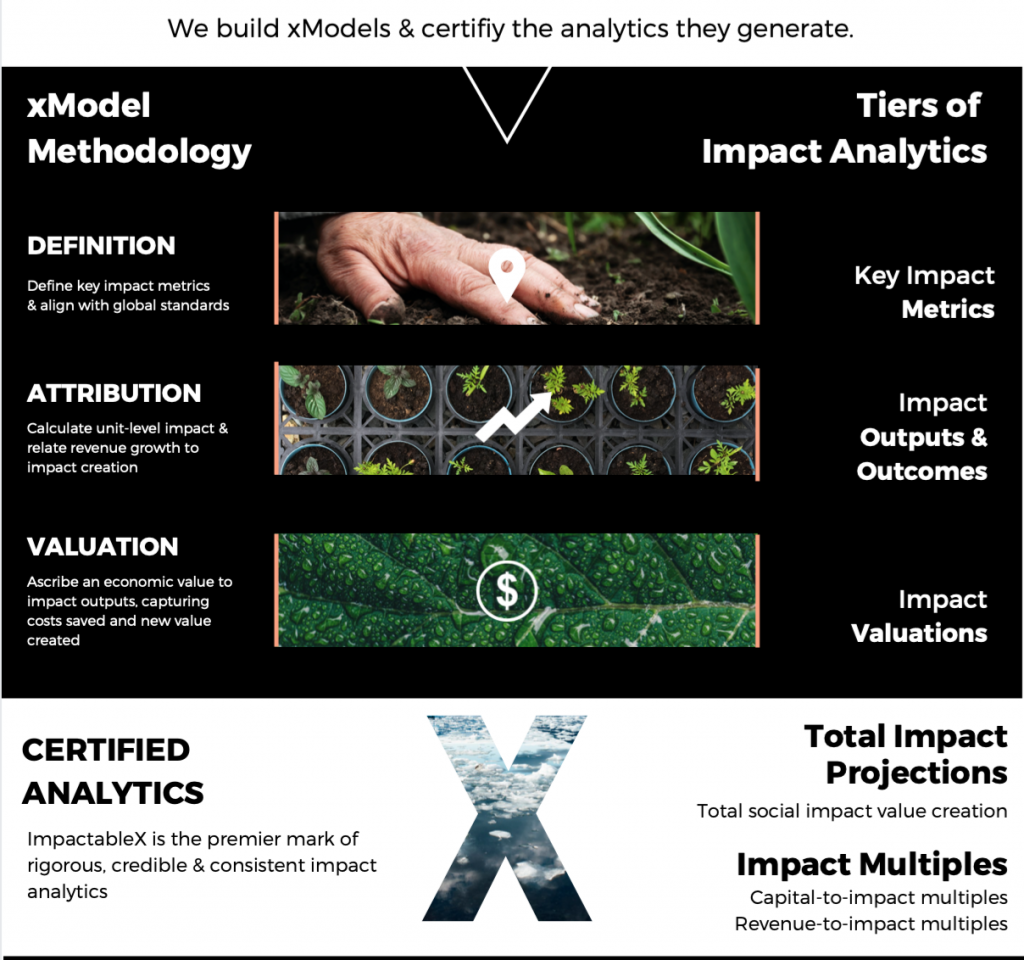

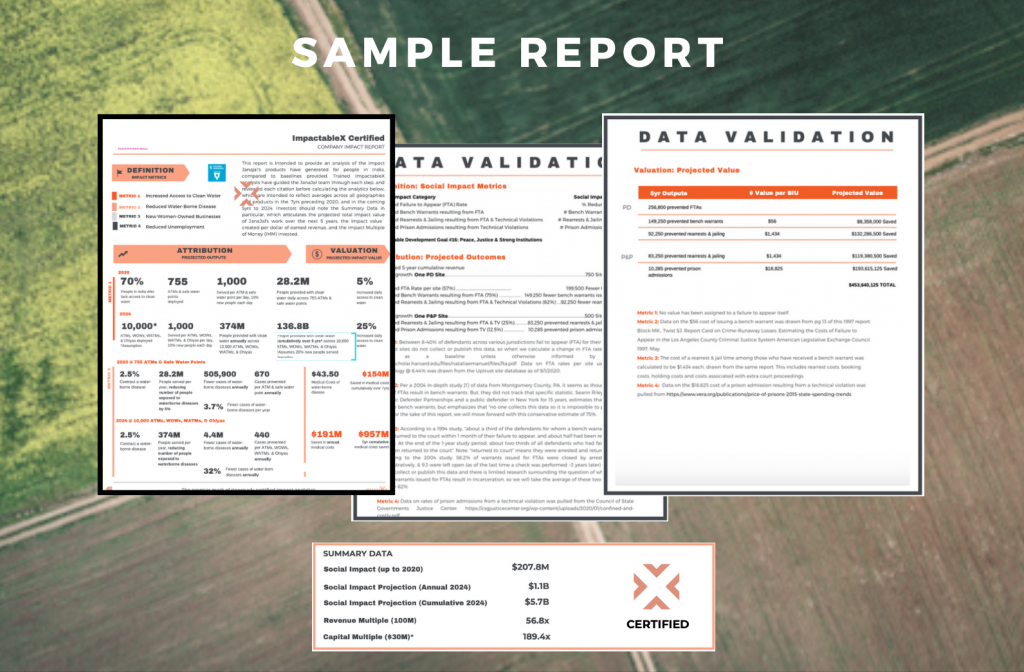

As founder and CEO of ImpactableX Analytics, Catherine helps social entrepreneurs and their investors to leverage data that can drive impact at scale. Her cutting-edge approach to impact modeling democratizes impact data and analytics by delivering a seamless and dynamic UX and generating analytics that uniquely engage investors, driving capital to the innovations with the greatest potential for meaningful impact.

Prior to launching ImpactableX, Catherine served as Managing Director at an award-winning impact accelerator, GoodCompany Ventures, where she built multiple global and cross-sector social innovation consortiums designed to catalyze and accelerate the application of new technologies to address the world’s most pressing challenges. In 2014, she led the execution of FastFWD, a partnership between the City of Philadelphia, Bloomberg Philanthropies and the Wharton Social Impact Initiative, designed to address the City’s public safety challenges.

Leveraging the success of this work, Catherine built a partnership with the Obama Administration’s Climate Data Initiative in 2017 called Climate Ventures 2.0. Focused on addressing threats to food and water systems from changes in climate, she focused the data, tech resources and expertise of organizations like NASA, the EPA, General Mills, Google, SAP and IBM, to accelerate and launch 10 tech companies with funding and pilot opportunities directly with cities around the US. Her work has been featured in Forbes and the New York Times, among others.

Catherine has a BA from the University of Pennsylvania and is an Adjunct Professor at Temple University.

I sat down with Catherine at the end of 2020 to learn more about her approach about translating social enterprises’ impact into economic terms:

“We work with social entrepreneurs to get clear on the impact mechanics and operations of their business. The approach that we take to doing this is hard-won over years of working directly with founders. We managed an accelerator called GoodCompany Ventures in Philly for several years. It was founded in 2009, I joined in 2013 and we worked with hundreds of early-stage social entrepreneurs over the course of the program. Originally, we were sector-agnostic but eventually mounted national and increasingly global innovation consortia over time.

One was Mayor Bloomberg’s Challenge Award, which brought in a Million dollars as prize money that allowed us to work on really tough public safety issues in Philadelphia. We ran two cohorts of ten entrepreneurs and many of them are now backed by some of the more renowned impact investors out there as well as venture tech.

Following that we had an opportunity to work with the Obama Foundation on climate adaptation innovation. We arranged 80+ different industry partners and capital coaches to channel the resources of the climate data initiative to entrepreneurs. It was over the course of that engagement that we really saw the consequences of not having impact data. Social entrepreneurs have this belief system that their impact is good for the world; and most people would agree that they’re making a difference. For example, most people would agree that reducing recidivism is a good thing but we got to the point where we needed to compare which approaches were more effective and what is missing.

We found that most entrepreneurs were building and managing their companies blind to the impact consequences and with that, investors really had no way to understand where they could place their capital for the greatest impact leverage.

And so we developed a methodology that meets early-stage founders where they are. As with any early-stage venture, they have little time, primary data and resources but massive potential to engage investors and other stakeholders around that potential. Once they have that data, we can help incorporate it into their messaging and business model to optimize for revenue and impact which helps engage with investors. Increasingly, I’m talking to investors who are keen on collecting these analytics among their portfolio companies and evaluating the data points at a higher aggregate level. Which is a whole other conversation and really fascinating!

I think the space is just really thirsty for this guidance and these data points and we’re trying to respond to that demand through our services.”

Translating impact into a shared language

Interpreting impact through a financial lens can be controversial but if we’re talking around systems change, that’s the type of information we need.

“Keep in mind that all of us involved in creating systemic change come from different perspectives with different skillsets and mandates. There are for-profit entrepreneurs addressing social and environmental challenges, philanthropy, venture capital, entrepreneurship policy, sometimes international development. We all need to come to the table if we really want to move the needle but just imagine how different the languages are that we all speak.

To take action toward a shared vision, it is critical that we’re all looking at the same information and agreeing to the same basic terms.

For example, the cost of one inmate returning to prison within a year in San Francisco is going to have different economic effects compared to recidivism in Southeast Asia or Africa or Italy. Having a way to account for these geographic differences allows us to go even farther by taking into consideration education or health consequences; suddenly demographics come into play. And we are able to generate the analytics telling the story of the cascading effects of recidivism vs. a social enterprise preventing recidivism. And to go one level deeper: By capturing the economic implications of that impact, we can differentiate between a social enterprise that, for example, serves two people on a very deep level versus another one that serves a thousand people at a shallow level versus a third venture that serves a thousand people at a deep deep level.

Transparency is critical.

Our job is to put all of these pieces clearly out on the table so that investors and entrepreneurs can have an informed, data-driven conversation about the impact assumptions and the research that informed them. Without these conversations in which all parties speak the same language, the impact space cannot evolve.

As long as impact is not evaluated properly, it’s going to be a nice-to-have.

Being able to quantify economic effects allows us to translate impact into economic terms which then allows us to evaluate it within the lens of the economy and I firmly believe that as long as impact is not evaluated that way it’s going to be a nice-to-have. It’s going to remain on the sidelines of the economy because until we can translate it into the language of capital and economics, decision-makers won’t know how to account for that impact – and I can’t blame them. That’s why we generate analytics that look at capital-to-impact leverage or revenue-to-impact-leverage: These rations allow investors to see their ownership stake and what impact is created with that investment. Integrating impact analytics into financial management practices is absolutely critical to professionalize and elevate the social enterprise space.”

Impact Models for social enterprises

“One of the benefits of our approach that entrepreneurs rave about is that none of the data points that we generate are written in stone. More importantly, we build a model for a company so that they understand exactly what the inputs are to generating their analytics because they’re bound to change over time. For example, assume they change their five-year sales projections or they collect more primary data that proves the social enterprise is actually able to affect twenty percent of inmates from returning to prison instead of the seven percent they initially projected, the business can make changes based on these updated inputs within a stable formula. Business, like life, is dynamic and we feel it’s important to meet entrepreneurs where they are, knowing full well that their businesses are going to progress and change course.

Nobody is going to hold a founder to her/his/their five-year financial projections, right? The same is true on the impact side, that’s why we believe in providing a dynamic framework and complete transparency. So as we get smarter we can make changes and we can have a conversation about exactly what assumptions and expectations and data points are feeding into it.”

Quantifying impact for investors

“Impact investors are constantly pitched to. Just imagine how bewildering it is at times: As an investor I have a responsibility to manage the investments of my partners.

Everybody tells me an amazing story about how they’re going to change the world. How do I know which one to believe?

Having that common language is a way for social entrepreneurs to convey with hard numbers exactly how they think they can create impact in the world. Providing data points that meet investors where they are is powerful. You can have a real conversation along the lines of: ‘For every dollar of capital you invest, I can multiply it by x and create [y type of] impact in this category.’

Not only do I believe we support social entrepreneurs to build more effective businesses but we also help impact investors do their job effectively. As of now, there are still a lot of missing pieces and we are working to bring them all together and more power to the impact space overall.”

Advice for social entrepreneurs on how to get started

“The first place to start is to get clear on what your metrics are. Sometimes this is straightforward and sometimes it’s not, but that is absolutely the first step. Talking about tons of carbon abated from the atmosphere is a very straightforward one. It gets a little trickier if you are talking about inmates prevented from reincarceration or individuals from certain populations that are able to graduate from university who wouldn’t have otherwise.

Get really clear on what happens in the world now that wouldn’t have happened without your work. Put down in writing what your expectations are about the measurable expressions of your impact.

I hear so many founders talk about wanting to build community or a sense of belonging or improving education, but what does that actually mean? How are your customers better off because of what you do? Make it as tangible as possible.

The very next step is thinking through their impact at a unit level. That unit can be a person, a product sold, a farm or school or prison, the list goes on depending on your impact area and business model. What is your unit of growth? That’s a really great way to start small and break it down into more manageable chunks.

Once you have that unit level impact understanding you’re able to then extrapolate based on the number of units you sold or you expect to sell.

More generally speaking, I recommend every social entrepreneur take a look at the Sustainable Development Goals (SDGs). Lots of investors start there and think through which SDGs they want to promote through their investments. If you can figure out how your innovation plugs into a specific SDG, the targets and indicators can be a good first step.

Another resource to explore is Iris+ which just released a core metric set so folks can go there and get a better idea though I have to say that it is all encompassing and very granular. Or you can simply reach out to me!”

Catherine Griffin

Philadelphia, PA, USA

Impact translator and data lover. Democratizer of impact data. Founder and adjunct professor.